Ahluwalia Contracts secure new contracts aggregating to Rs 580 crore in Q3

Ahluwalia Contracts secure new contracts aggregating to Rs 580 crore in Q3

Electrosteel Casting’s Q3 net profit down 26.34%

Electrosteel Casting’s Q3 net profit down 26.34%

Rane Brake Lining’s Q3 net profit up 50.48%

Rane Brake Lining’s Q3 net profit up 50.48%

Alstom Projects declines on reporting 53.20% drop in Q3 net profit

Alstom Projects declines on reporting 53.20% drop in Q3 net profit

J.Kumar Infraprojects bags orders aggregating to Rs 49 crore

J.Kumar Infraprojects bags orders aggregating to Rs 49 crore

Hyderabad Industries fixes record date (05 Feb 2011)for interim dividend

Hyderabad Industries fixes record date (05 Feb 2011)for interim dividend

IPCA Laboratories board declares second interim dividend (rs 1/sh)

IPCA Laboratories board declares second interim dividend (rs 1/sh)

Global joblessness at alarming levels in 2010: ILO Report

Global joblessness at alarming levels in 2010: ILO Report

Hindustan Unilever reports marginal drop in Q3 net profit

Hindustan Unilever reports marginal drop in Q3 net profit

Finance ministry revises up FY11 revenue target to Rs 7.82 lakh crore

Finance ministry revises up FY11 revenue target to Rs 7.82 lakh crore

Ultratech Cement reports stellar Q3 numbers

Ultratech Cement reports stellar Q3 numbers On Tuesday Jan 25 2011, The domestic share market extending previous session gains continued their upward journey uptill early noon session tracking firm regional counterparts. The trade was pretty range bound ahead of the RBI policy review. Both the barometer indices gyrated around their physiological level of 19000 mark -Sensex and 5700 mark-Nifty respectively as the traders were worried about the hawkish tone of the macro-economic report, ahead of the central bank's quarterly policy review. RBI implemented yet another rate hike on Tuesday when it issued the last quarterly review of monetary policy for the current financial year. The action however was much in line with the market expectations as most analysts expected at least a 25 bps hike in wake of recent surge in inflation seen in December. Post to which, the repo and reverse repo rates stood at 6.5% and 5.5% respectively. Though, the rate hike was much in line with expectation, but the RBI Inflation forecast for March to 7% from the earlier forecast of 5.5%, pinched Indian markets to shrug off its gains. Soon the markets slipped into the red and hit fresh intra day's low on fresh round of selling activities at several front line counters as investor's hassled over the possibility of more interest rate hikes by the RBI to tame inflation.

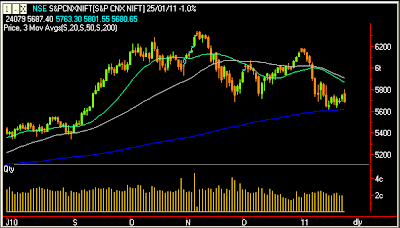

The BSE Sensex plunged 182.66 points or 0.95% to settle at 18,968.62 (Provisional). The index touched a high and a low of 19,340.99 and 18,949.44, respectively.(Provisional).There were 14 stock advancing against 16 declining on the index.(Provisional). The S&P CNX Nifty tanked 58 points or 1.01% to settle at 5,685.25 (Provisional). The index touched a high and a low of 5,801.55 and 5,680.65, respectively.(Provisional). There were 16 stocks advancing against 34 declines on the index (Provisional)

The BSE Sensex plunged 182.66 points or 0.95% to settle at 18,968.62 (Provisional). The index touched a high and a low of 19,340.99 and 18,949.44, respectively.(Provisional).There were 14 stock advancing against 16 declining on the index.(Provisional). The S&P CNX Nifty tanked 58 points or 1.01% to settle at 5,685.25 (Provisional). The index touched a high and a low of 5,801.55 and 5,680.65, respectively.(Provisional). There were 16 stocks advancing against 34 declines on the index (Provisional)  The BSE Mid-cap and Small-cap indices too edged lower by 0.42% and 0.29% respectively (Provisional). The gainers in the BSE sectoral space was CD up by 1.17%, Power up by 0.42%, CG up by 0.19%, (Provisional). On the other hand, Bankex down by 2.30%, FMCG down by 1.79%, Realty down by 1.33%, HC down by 1.07% and Auto down by 1.06% were the major losers in the BSE sectoral space (Provisional).

The BSE Mid-cap and Small-cap indices too edged lower by 0.42% and 0.29% respectively (Provisional). The gainers in the BSE sectoral space was CD up by 1.17%, Power up by 0.42%, CG up by 0.19%, (Provisional). On the other hand, Bankex down by 2.30%, FMCG down by 1.79%, Realty down by 1.33%, HC down by 1.07% and Auto down by 1.06% were the major losers in the BSE sectoral space (Provisional).

Read More about: Equity Research Report By Mansukh