F & O HIGHLIGHTS

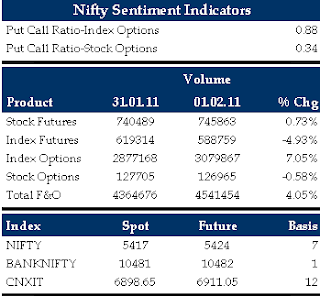

Nifty February 2011 futures closed at 5423.75, at a premium of 6.55 points over spot closing of 5417.20, while Nifty March 2011 futures were at 5436.55, at a premium of 19.35 points over spot closing. The near month February 2011 derivatives contracts expire on Thursday, February 24, 2011. Nifty February futures saw an addition of 21.18% or 4.33 million (mn) units, taking the total outstanding open interest (OI) to 24.78 mn units.From the most active underlying, Tata Motor's February 2011 futures closed at a premium of 1.95 points at 1070.50 compared with spot closing of 1068.55. The number of contracts traded was 42333.SBI's February 2011 futures were at a premium of 7.75 points at 2601.85 compared with spot closing of 2594.10.The number of contracts traded was 27782.

ICICI Bank February 2011 futures were at discount of 0.50 points at 991.50 compared with spot closing of 992.00. The number of contracts traded was 30766.Tata Steel February 2011 futures were at a discount of 1.25 points at 630.30 compared with spot closing of 631.55. The number of contracts traded was 23504.Reliance Industries February 2011 futures were at premium of 6.90 points at 901.50 compared with spot closing of 894.60.The number of contracts traded was 31472.

Nifty Option Open Interest Distribution

Nifty Feb 5500 call added 28.11 lakh shares in OI, up 101.42% and 5600 call added 9.15 lakh shares in OI, up 25.34%. On the put side nifty Feb 5400 put added 9.45 lakh shares in OI, up 12.49% and 5300 put added 3.39 lakh in OI, up 9.17%. The put-call ratio of stock option increased from 0.32 to 0.34 while put-call ratio of index option decreased from 0.96 to 0.88. On the whole the put call ratio was at 0.85.

Analyst

Pashupatinathjha@moneysukh.com

NIFTY OUTLOOK:

The nifty future is likely to trade in the range of 5356-5795 level in short term as the OI is added. The trading strategy would be to create short positions if the nifty resists around 5620 levels for the target of 5550 and 5500. On the other hand, one can also create long positions if the nifty gets support around 5450 levels.

Nifty Feb 5500 call added 28.11 lakh shares in OI, up 101.42% and 5600 call added 9.15 lakh shares in OI, up 25.34%. On the put side nifty Feb 5400 put added 9.45 lakh shares in OI, up 12.49% and 5300 put added 3.39 lakh in OI, up 9.17%. The put-call ratio of stock option increased from 0.32 to 0.34 while put-call ratio of index option decreased from 0.96 to 0.88. On the whole the put call ratio was at 0.85.

Analyst

Pashupatinathjha@moneysukh.com

NIFTY OUTLOOK:

The nifty future is likely to trade in the range of 5356-5795 level in short term as the OI is added. The trading strategy would be to create short positions if the nifty resists around 5620 levels for the target of 5550 and 5500. On the other hand, one can also create long positions if the nifty gets support around 5450 levels.