FIRST LIGHT HEADINGS

MFs stand as net buyers in equities on February 17: SEBI

Kirloskar Oil sells its bearings business division for Rs 87 crore

Reliance Broadcast Network’s radio arm inks strategic alliance with Bhutan’s High FM

India says no to global capital control mechanism

Facor Group signs contract with Baosteel & Shanghai Tsingshang Mineral

Kingfisher Airlines mulls to join global airline alliance 'Oneworld'

Nestle India’s FY10 net profit expands by 25%

Adani Enterprises signs MoU with Carbon Energy

Forex reserves drop $752 Million to $298.663 billion

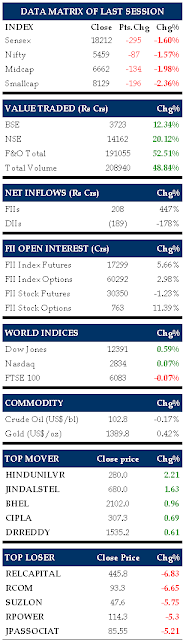

MARKET INDISE

On Friday 18 Feb 10, 2011, The domestic equity markets after continuing their winning streak for past five consecutive sessions snapped the last trading day of the week on an dismal and apprehensive note, thereby giving the sense that the markets will correct further in the coming week given the fiscal situation, the inflationary trend and above all the growing unease with the corruption that has become a big headache for the Congress-led ruling coalition at the centre. The benchmark indices started on firm note tracking the overnight gains of the Wall Street but edged lower within few minutes of trade as the section of traders appeared keen on booking some profits ahead of the weekend, while some of the investor's shortened their position in order to avoid the exposure of the equity markets approaching the F&O February series expiry. The non participation of the skeptical foreign institution also added to the turbulence of the Indian equity market as the number of foreign fund managers kept themselves on the sidelines, keeping a watch on the developments on the domestic front. It was the weakness from the stocks of Realty, Auto and Oil & Gas sectors coupled with market's resistance at higher levels amidst active bears that the indices drifted lower. The local bourses witnessed highly volatile day of trade amidst alternate bouts of buying and selling in blue chip stocks, even small effort of recovery was reciprocated by the spell of profit booking. The market went on declining path and the widely followed 50 share index--Nifty--on NSE breached its key physiological level of 5500 mark.

The BSE Sensex tumbled 295.30 points or 1.60% to settle at 18,506.82. The index touched a high and a low of 18,506.82 and 18,159.82, respectively.5 stocks advanced against 25 declining ones on the index (Provisional). India VIX, a gauge for market's short term expectation of volatility, gained 7.13% at 24.18 from its previous close of 22.57 on Thursday (Provisional). The S&P CNX Nifty trimmed 79.35 points or 1.43% to 5,467.10. The index touched a high and a low of 5,599.25 and 5,441.95, respectively. 11 Stocks advances against 39 declining one's on the index (Provisional).

The BSE Mid-cap and Small-cap indices went home with a loss of 1.98%, and 2.35%, respectively (Provisional). All the BSE sectoral indices were in red. Realty down 4.04%, Auto down 2.39%, Oil & Gas down 2.09%, Capital Goods (CG) down 1.97% and CD down 1.84% were the major losers (Provisional).

On the global front, Asian shares finished their best week in two months on Friday as fading concerns over inflation encouraged investors to chase for value in beaten down markets. Meanwhile, European shares rose for the sixth straight session hovering around 29 month highs following bullish US regional manufacturing data.l.

Read more about Equity Research Report