FIRST LIGHT HEADINGS

FIRST LIGHT HEADINGSIndia’s exports for February 2011 jumps 50% to $23.6 billion

ING Vysya Life Insurance targets to collect Rs 1,939 crore premium by 2010-11 end

Godrej Properties acquire OK-Realty from HDFC Ventures

Morgan Stanley again cuts India's FY12 growth forecast to 7.7% from 8.2% India’s services PMI for February expand further; at 7 month high

NALCO floats aluminium export tender: Report

Pantaloon Retail increases prices of its branded apparel by 18 percent

Agricultural Ministry ties up with NIIT to promote IT usage for livestock management

LIC Housing to raise Rs 250 crore via Bonds: Report

Canara Bank mops up Rs 2,000 crore via share sale to institutional investor

MARKET INSIGHT

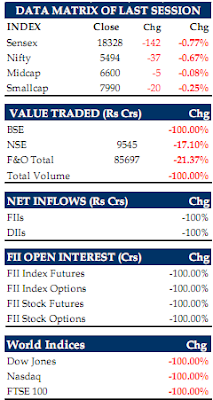

On Thursday 10 Mar, 2011 , trading got off to a weak start tracking weak global markets and lingering worries about the unrest in Libya, triggering some heavy selling at several front line counters from across various sectors. With no big triggers to prompt investors to go in for any significant buying, stocks mostly moved narrow range right since commencement of the day's trade up till the mid afternoon when the bourses attempted to get in green as easing food price inflation for the second consecutive week comfortedsome nervy investors. According to the data released by the ministry of commerce and

industry on Thursday, food price index rose by single digits to 9.52% for the week ended February 26, 2011 as compared to 10.39% seen in the previous week. However, markets repeating the previous session's story again recoiled to languish in the red with major losses due to sustained selling pressure with weak global markets, high oil prices continuing to hurt sentiment to a significant extent. Though there was some covering approaching the close but the markets finally settled yet another day of trade in red.

The BSE Sensex tanked 156.63 points or 0.85% at 18,313.32 (Provisional). The index touched a high and a low of 18,430.84 and 18,261.26, respectively.9 shares advanced against 21 declining one's on the index (Provisional). The S&P CNX Nifty trimmed 35.75 points or 0.65% to settle at 5,495.25. The index touched high of 5516.30 and a low of 5468.45 respectively.19 stocks advanced against 30 declining one's on the index

(Provisional)..

The BSE Mid-cap index and small cap index lost 0.11% and 0.25%, respectively (Provisional). All the BSE sectoral indices with an exception of Realty that ended up in green by 0.52% (Provisional) were trading in the red. Metal down 1.31%, Bankex down 1.20%, IT down 0.69% TECk down 0.67%, and Fast Moving Consumer Goods (FMCG) down 0.59% were the major losers in the BSE sectoral indices (Provisional).

All the Asian equity indices finished the day's trade in the negative terrain on Thursday as increasing unrest in Libya and China's unexpected trade deficit for February sparked a selloff in the region. Chinese Shanghai Composite crumbled about one and a half percent after the country posted a $7.3 billion trade deficit in February, compared with

Read more about Equity Research Morning Report By Mansukh