FIRST LIGHT HEADINGS

Seamec enters into contract with Swiber Offshore Construction, Singapore

Opto Circuits’ US arm secures a contract to deploy 650 Powerheart AEDs in Girona, Spain

Panama Petrochem gets Gujarat HC approval for scheme of amalgamation

Ingersoll-Rand (India) to set up additional manufacturing facility

Areva T&D India bags eBOP contract for Visa Power

Nomura pegs headline inflation in FY12 at 8.6%

MARKET INSIGHT

On Wednesday 27April 2011,local bourses started on positive note tracking higher closing of Wall street and gains in regional counterparts, however, Wipro reported its bleak outlook and as knee jerk reaction markets shaved off their gains to trade in red, however, after that mild setback the bourses did recover as selective buying by funds and retail investors in stocks having strong fundamentals and a firming trend on other Asian bourses supported the trading sentiment. But going further, in the after- noon session of trade, the benchmarks despite substantial resilience drifted lower as investors were reluctant to go for broad based buying and indulged only in stock specific activities amid dearth of positive triggers. Besides, IT and Bankex sector, metal and CG too witnessed profit booking, however, broader indices held their heads above the water. But as the selling pressure intensified equity markets started trading around their day's low, and despite some recovery failed to end in green..

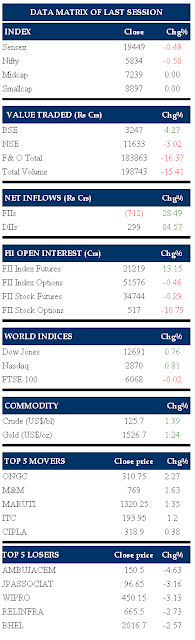

The BSE Sensex lost 103.36 points or 0.53% and settled at 19,441.99. The index touched a high and a low of 19,633.63 and 19,412.79 respectively. 7 stocks advanced against 23 declining one's on the index. The BSE Mid-cap and Small-cap indices were down by 0.07% and 0.05% respectively. (Provisional) On the Bombay Stock Exchange Sectoral front, Fast Moving Consumer Goods (FMCG) up 0.52%, Public Sector Undertaking (PSU) up 0.45%, Health Care (HC) up 0.13% and Consumer Durables(CD) up 0.04% were the top gainers. On the flip side Realty down 1.65%, Capital Goods down 1.21%, Metal down 0.97%, Power down 0.80% and Bankex down 0.68% were the top losers.

India VIX, a gauge for market's short term expectation of volatility lost 1.65% at 21.35 from its previous close of 21.71 on Tuesday. The S&P CNX Nifty lost 36.75 points or 0.63% to settle at 5,831.65. The index touched high and low of 5,892.35 and 5,819.95, respectively. 11 stocks advanced against 39 declining ones on the index. (Provisional)

Most of the Asian equity indices finished the day's trade in the positive terrain on Wednesday tracking the US markets which moved higher on good corporate earnings, boosting the outlook for Asian exporters. Japanese Nikkei surged about one and a half percent, shrugging off Standard & Poor's to revision of the outlook on its long-term rating on to negative from stable. Moreover, Taiwanese stocks closed with a gain of over a percent, lifted by surge in financial and semiconductor heavyweights as investors raised long positions in an increasingly optimistic environment.

Bankers feel that with current stance of monetary policy, credit growth in 2011-12 could work out to be anywhere between 18-22%, against 21.4% seen in fiscal 2010-11. However, if the central bank continues monetary tightening in 2011, resulting in say another 100 bps of cumulative hike in repo rate, credit growth could be around 75-150 bps lower than what it would otherwise be. This would peg loan growth estimates for FY12 in 17-21% range which is not bad for expected growth of around 8% in GDP over the FY12.

Read more about Indian Equity Research Morning Report By Mansukh